xSuite Blog

Expert Knowledge on Digitalization & Automation of Business Processes

xSuite Blog

Expert Knowledge on Digitalization & Automation of Business Processes

The Swiss QR Code: A Gentle Introduction to Electronic Invoice Processing

Topic: Digitalization | AP Automation | E-Invoicing

Big changes are currently affecting electronic invoicing in Europe. In EU states, these changes are being made in response to EU Directive 2014/55/EU, which stipulates that all public contracting authorities and entities in the EU must be able to accept and process electronic, machine-readable invoices.

Germany has gone a step further, requiring that not only public contracting authorities and entities but also their suppliers comply with the directive. From November 2020 onward, federal contracting authorities and entities as well as those of the state of Bremen will only accept electronic invoices, with few exceptions. The format developed for this purpose is called XRechnung.

With invoice recipients and senders in Germany currently preparing for XRechnung, now is a good time to take a look at what our neighbors in Switzerland are up to. Of course, EU directives do not apply there, but Switzerland has found its own way of digitizing and automating invoicing processes.

The current situation in Switzerland: an invoice plus a red or orange payment slip

Currently, invoices sent in Switzerland are generally accompanied by payment slips. These slips contain the information necessary for paying the bill. They are equivalent to the (pre-filled) transfer forms used in Germany. The payment slips come in various forms: in orange and red, with and without reference numbers, from banks and from PostFinance.

However, this will be changing. Steps are being taken to digitize and automate invoice processing. Starting on June 30, 2020, payment slips will be replaced by QR codes containing payment information such as account holder, amount due, IBAN (or a special QR IBAN) and currency (both EUR and CHF will be possible).

Application: what is possible with the Swiss QR code

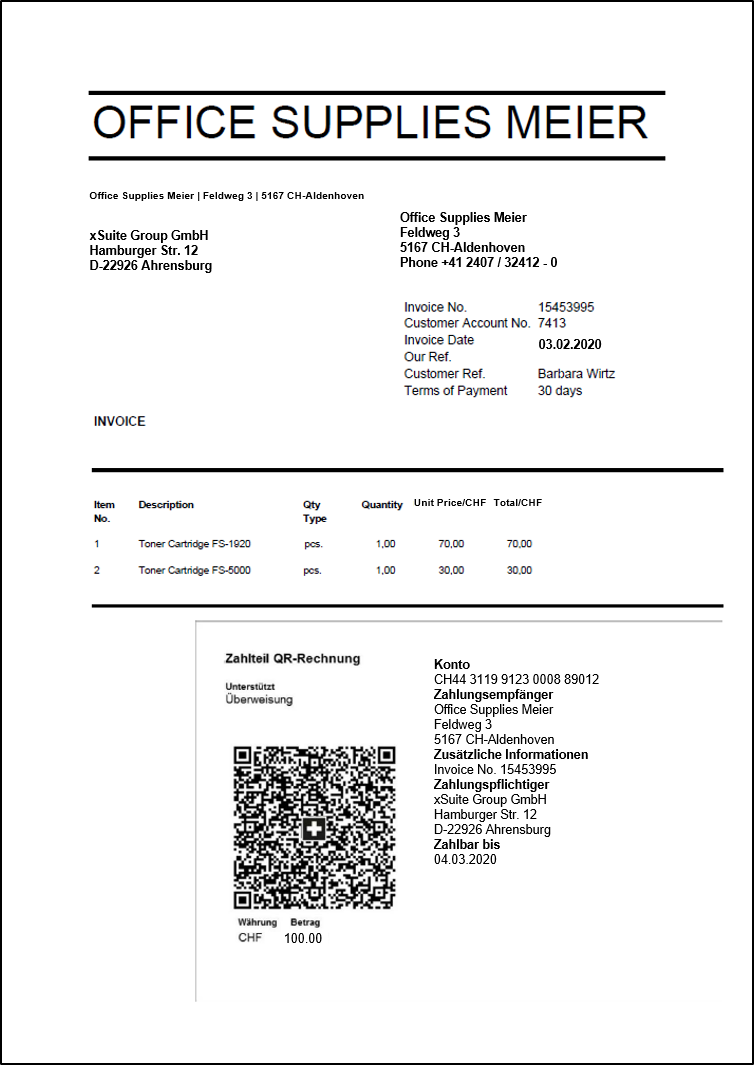

This QR code is called the “Swiss QR code.” And its identifying feature is the Swiss Cross in the center. It can be located on the bottom-right of the invoice itself or can be sent as an attachment to the invoice. The Swiss QR code can be used for both paper and electronic invoices (e.g. in PDF format).

Invoices accompanied by red and orange payment slips can still be used during a transition period, but as yet it is unclear how long this transition period will be. In any case, Swiss companies should immediately begin preparing for invoices with the Swiss QR code.

Invoices accompanied by red and orange payment slips can still be used during a transition period, but as yet it is unclear how long this transition period will be. In any case, Swiss companies should immediately begin preparing for invoices with the Swiss QR code.

To ensure that everyone, including private end users who do not have a smartphone or any other method of reading QR codes, can read the billing details in a QR invoice, the content of the QR code will also be written out. An invoice with a Swiss QR code will look something like the one below:

Advantages and disadvantages of the Swiss QR invoices

The use of the Swiss QR code in invoices provides a gentler introduction to electronic invoice processing than the XRechnung in Germany. Firstly, Swiss invoices will still be fully readable to the human eye and will not require the use of additional tools. Secondly, only the payment information will be machine-readable. The invoice itself will not change. This gentle introduction suggests that there will be little resistance to the change. In addition, the approach allows private end users to be integrated more easily.

On the other hand, however, Swiss QR invoices lack some of the advantages offered by XRechnung. The QR code will still have to be scanned and read, a process subject to the same kind of limitations that affect all other scanning processes. The Swiss QR code must therefore meet detailed requirements with regard to print quality, color, size, font, and paper type and thickness in order to ensure good scan results and keep errors to a minimum. In addition, the Swiss QR code contains only the payment details and by no means all the contents of an invoice. This means that companies must use other methods such as scanning, OCR, or manual data entry to enter invoice information such as item, VAT, date, etc. into their ERP system.

Topic

- AP Automation (28)

- Digitalization (28)

- SAP (18)

- Cloud (15)

- S/4HANA (10)

- E-Invoicing (9)

- Skills Shortage (6)

- Supplier Portal (6)

- AI and Machine Learning (5)

- Procurement (5)

- Invoice (5)

- GDPR (4)

- Software Development and Implementation (4)

- xSuite Group (4)

- Archiving (3)

- Usability and User Experience (3)

- RPA (2)

- Dynamic Discounting (1)

- Blockchain (1)

- Incoming Mail (1)